A. What Does Co-Ownership Interest Mean?

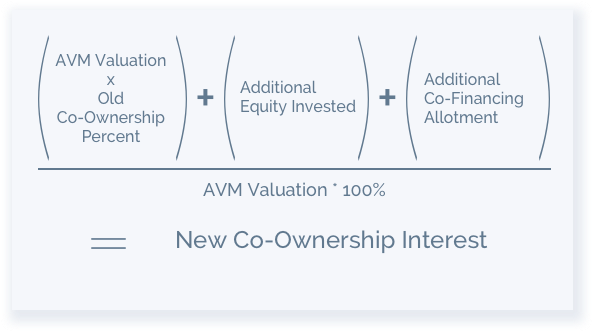

Co-Ownership Interest is based on the investments you've made in your Suite, which determine the portion of the Suite that you co-own.

As the Owner-Resident, you can increase your Co-Ownership Interest and transfer your Co-Ownership Interest to a Permitted Transferee, provided you follow the conditions set out in this Agreement and Applicable Laws.

Please refer to Article 4 in the Owner-Resident Agreement for more details about how this works.

ORA Ref: Article 4