A. Your Total Initial Cost

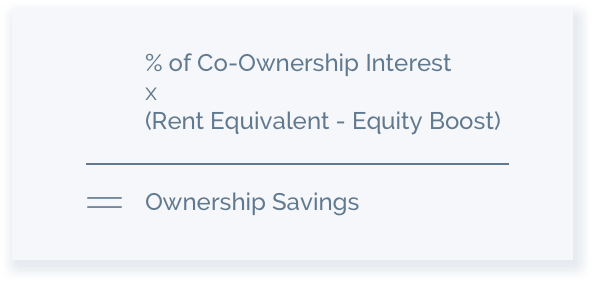

To become an with Key, you will need a minimum initial investment of 2.5% of the value of the Suite you want to live in. You're welcome to make a larger initial investment if you'd like to. In exchange for your initial investment, you will receive the following benefits:

- (i) The Owner-Resident’s initial Co-Ownership Interest including proportionate application of proportionate use of mortgage debt, if any;

- (ii) The exclusive right to occupy the Suite;

- (iii) Access to and use of the Building’s Common Areas and Facilities;

- (iv) Use of the Key App; and

- (v) The opportunity to leverage some debt with the Co-financing Benefit.

ORA Ref: Article 2.1

Owner-Resident

Any primary residents who have signed the Owner-Resident Agreement and have made the minimum initial investment for the Suite.